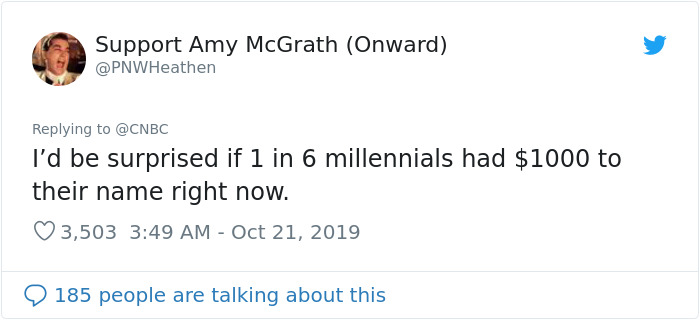

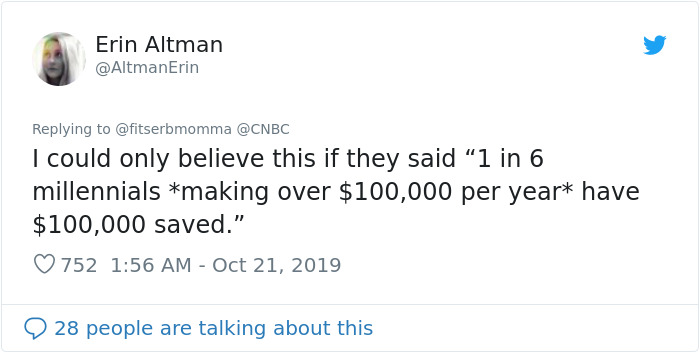

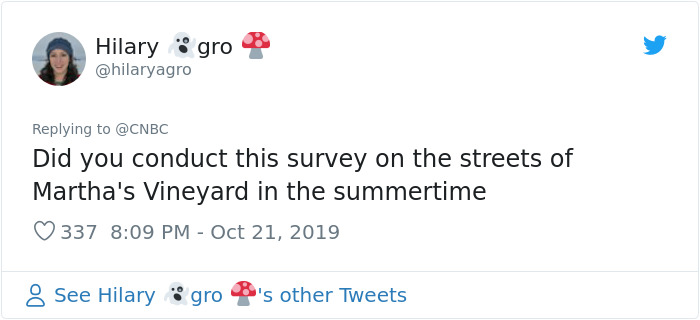

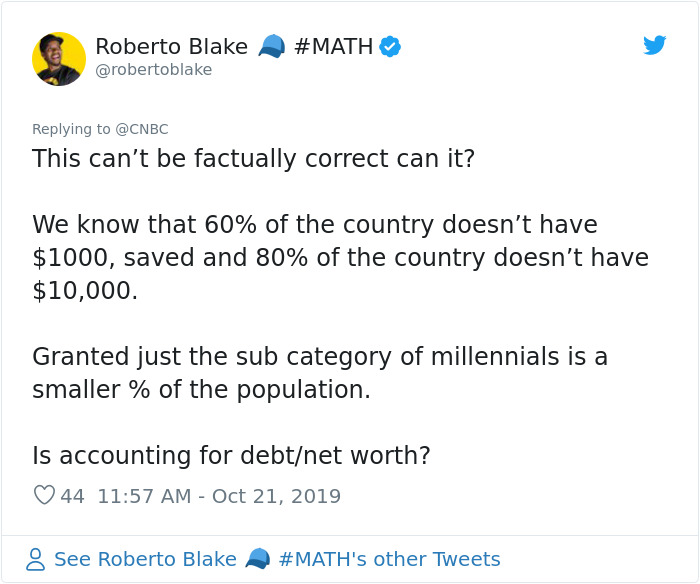

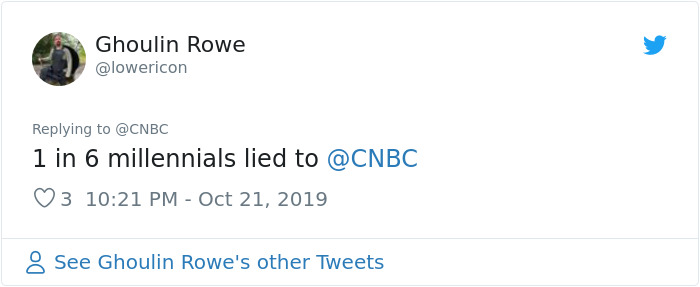

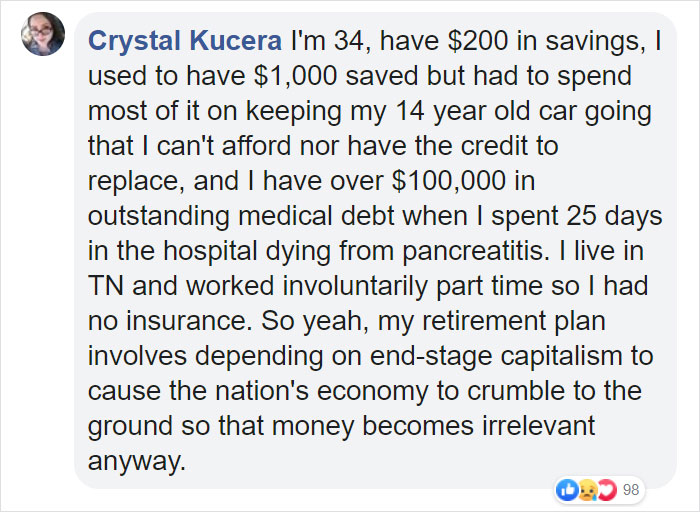

You probably have a gazillion bazillion doubloons saved up by the time you’re kind of (but not really) grown-up. Sounds completely ridiculous, doesn’t it? Let’s rephrase it in the way the Bank of America put it in its 2018 Winter report: a survey shows that 16 percent of millennials (or roughly one in six 23 to 37-year olds) have 100,000 dollars or more saved up.

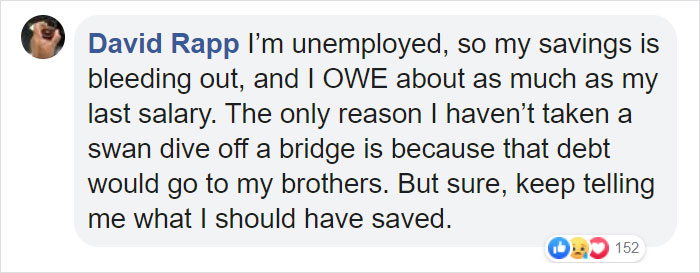

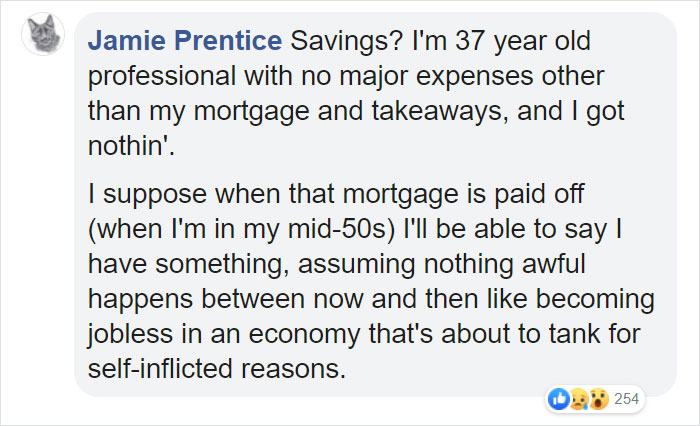

Unless you’re one of the few financially savvy, ingenious, or incredibly lucky millennials out there, you probably reacted much the same as the rest of the internet. With disbelief, raised eyebrows, and tears running down your face when you checked the contents of your piggy bank and realized it went piggy-bankrupt in the last economic crash.

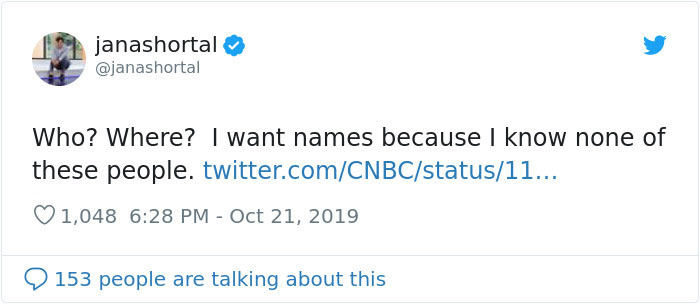

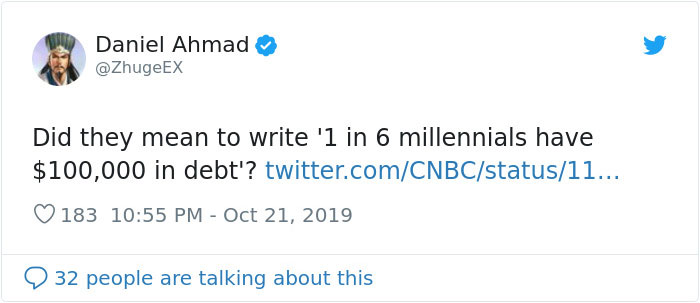

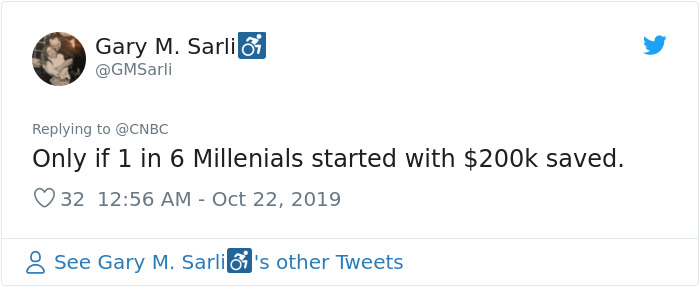

This tweet by CNBC about 1 in 6 millennials having 100,000 dollars in savings…

Image credits: CNBC

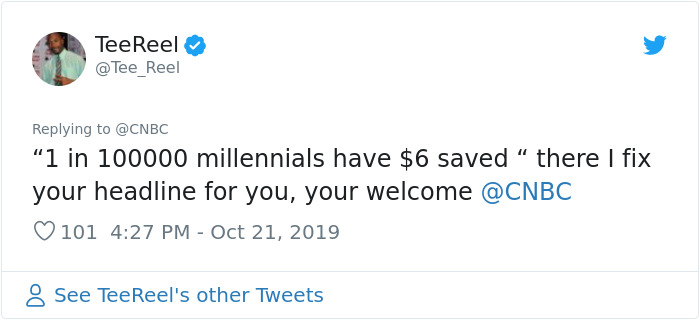

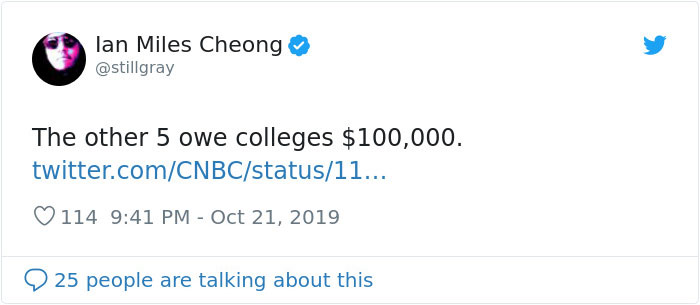

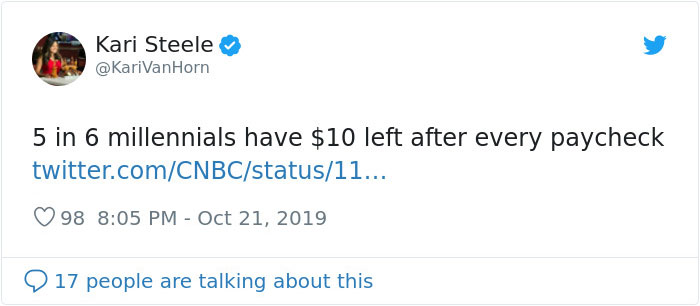

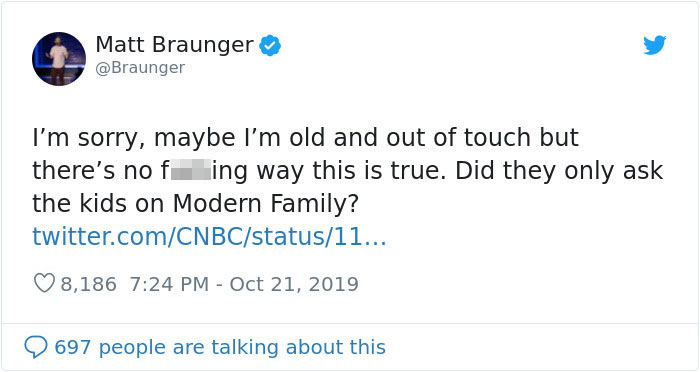

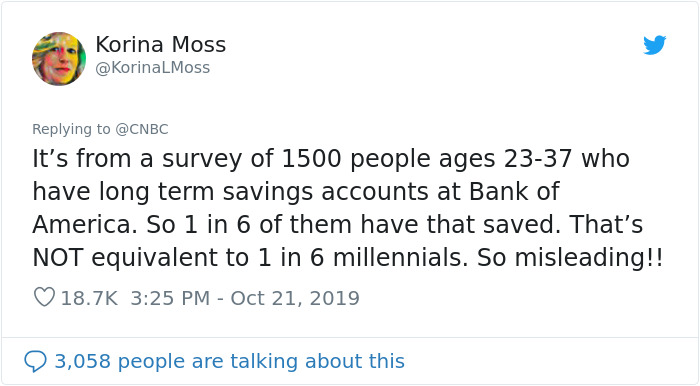

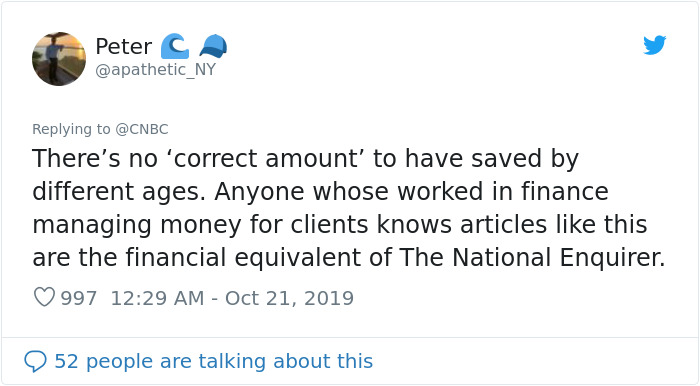

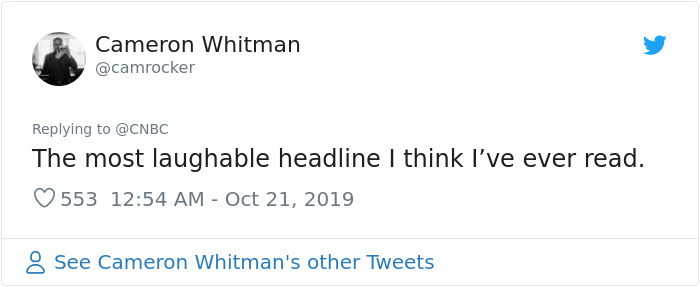

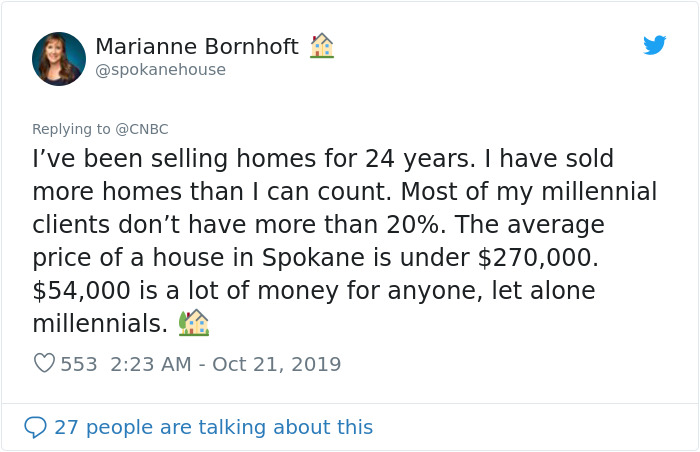

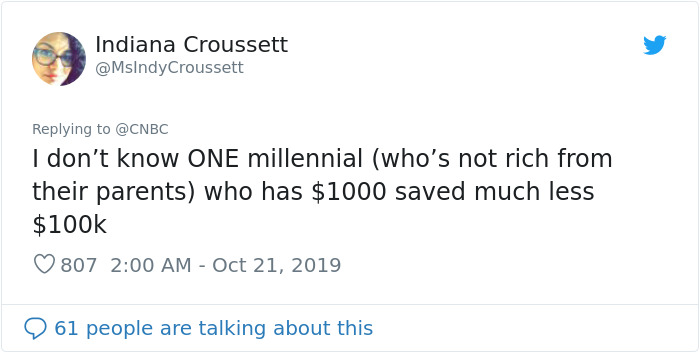

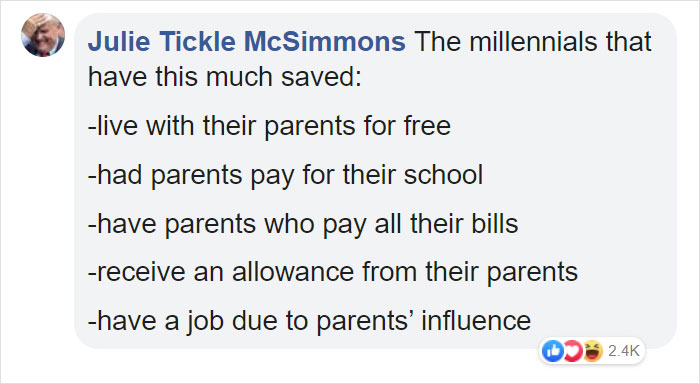

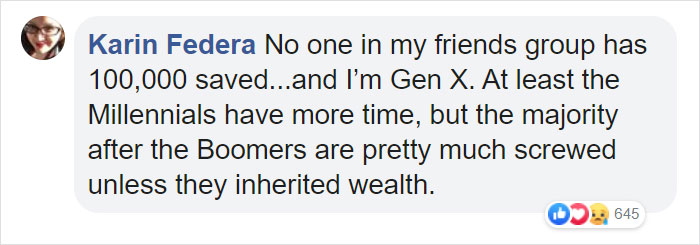

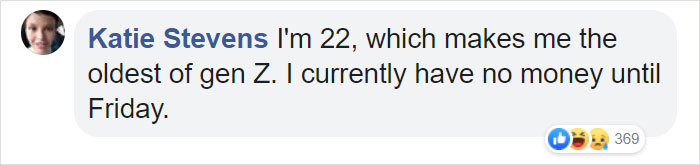

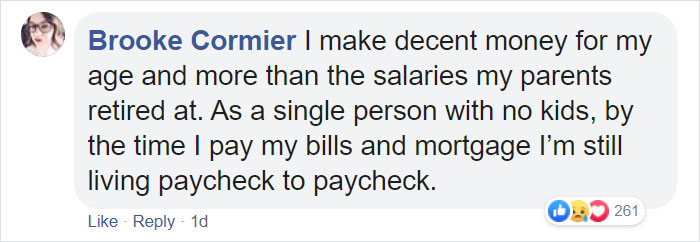

The internet responded to CNBC’s tweet about the survey’s conclusion with disbelief and a healthy dose of good humor. Some joked about the survey having mixed up the words ‘savings’ and ‘debt,’ others made references to the amount of money having been saved up in The Sims video game.

While still others attacked the report for surveying (in their opinion) ‘too few’ people to make firm conclusions that could extend to the entire millennial generation living in the United States.

…made the internet freak out and mock the data compiled by the Bank of America

Image credits: janashortal

Image credits: davidmackau

“I absolutely believe more than 1 in 6 millennials should have at least 100,000 dollars or more saved up if they ever want to achieve financial independence and not work at a job they hate for the rest of their lives,” Financial Samurai founder Dogen revealed his opinion to Bored Panda.

“Based on my 401(k) savings by age guide, you should have the following saved in your pre-tax retirement account by age:

-100,000 – 300,000 dollars by age 30

-250,000 – 1,000,000 dollars by age 40

-600,000 – 2,250,000 dollars by age 50

-1,000,000 – 5,000,000 dollars by age 60.”

-250,000 – 1,000,000 dollars by age 40

-600,000 – 2,250,000 dollars by age 50

-1,000,000 – 5,000,000 dollars by age 60.”

Image credits: stillgray

Image credits: KariVanHorn

Image credits: ZhugeEX

“If you want to retire before 60, you need to save even more in online brokerage account and other non-tax advantageous accounts. You can’t withdraw funds from your 401(k) or IRA before 59.5 without a 10% penalty. Here’s my after-tax investment amounts by age guide.”

Image credits: KorinaLMoss

Image credits: apathetic_NY

Financial expert Dogen explained that your mindset is incredibly important for your financial future and can help you save money: “You have to get in the right money mindset. If you are already telling yourself it is impossible to save money, of course, you’re not going to do everything possible to save money. My #1 piece of advice is: if the amount of money you’re saving each month doesn’t hurt, you’re not saving enough.”

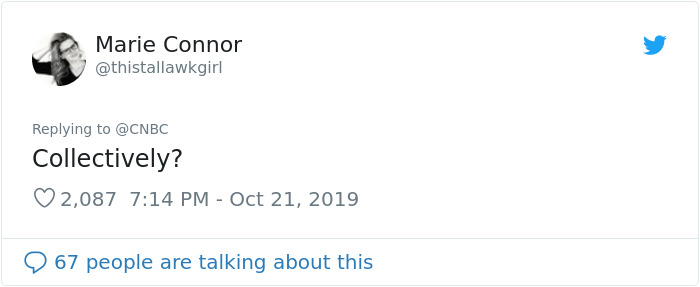

Image credits: GMSarli

Image credits: thistallawkgirl

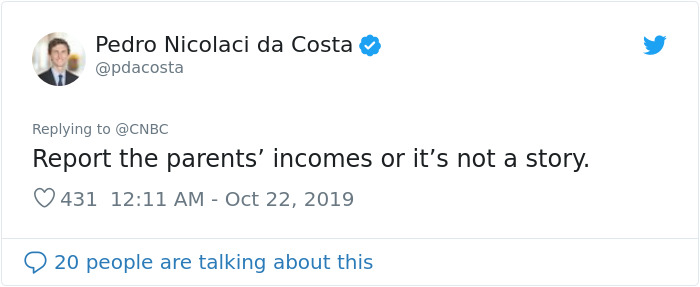

Image credits: pdacosta

He continued about possible ways to earn and save more money: “After you make saving money painful, then you’ve got to take on side hustles to make even more money. Freelancing online, driving a car, assembling furniture, tutoring, mowing lawns are examples of some common side hustles.”

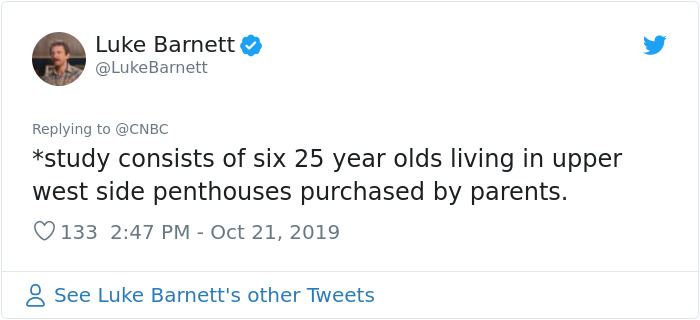

Image credits: LukeBarnett

Image credits: PNWHeathen

Image credits: camrocker

“The absolute bare minimum is to save at least 20 percent of your income after tax each month. If 20 percent feels like a lot, don’t worry. You will get used to living with 80 percent of your income or working other jobs to boost your income,” Financial Samurai said, noting that people are able to adapt to almost any living conditions. “If 20 percent doesn’t feel like enough, it’s imperative you keep ratcheting up your savings rate until you need to make lifestyle changes. Your ultimate goal is to try and achieve a 50 percent savings rate after taxes. Once you get there, every year you work will equal one year of living expenses.”

Image credits: spokanehouse

Image credits: MsIndyCroussett

Image credits: AltmanErin

Image credits: hilaryagro

Image credits: robertoblake

Image credits: RedHeadedAuthor

We all live in a fast-paced world and it’s impossible to give our full attention to every tidbit of information that passes across our radars. It’s just how the modern world works. That’s why it’s likely that the millennials criticizing the Bank of America report didn’t read the full report or aren’t focusing on the context.

Because having 100,000 dollars in savings was just a tiny part of the report. What’s more, the figure was right next to this down-to-earth fact: that 47 percent of American millennials have 15,000 dollars or more in savings. Now that sounds much more realistic, doesn’t it?

Moving beyond the Bank of America’s findings, the reality is that a large number of millennials talk about saving money, but few of them have enough financial knowledge to make smart decisions. This is backed by PwC US’ study that found that less than a quarter of recent college graduates have basic financial knowledge. Nearly a third overdraw their checking accounts, while a mere 27 percent seek professional advice on how to save and invest their hard-earned money.

So, dear Pandas, how much money do you have saved up? What’s your bank account number? Those were jokes, don’t answer those. Ever. Instead, tell us your tips for saving money and getting rid of debt!

Post a Comment